FIRST FINANCIAL CORP /IN/ (THFF)·Q4 2025 Earnings Summary

First Financial Posts Record Year as Loans Cross $4B, EPS Beats by 10%

February 3, 2026 · by Fintool AI Agent

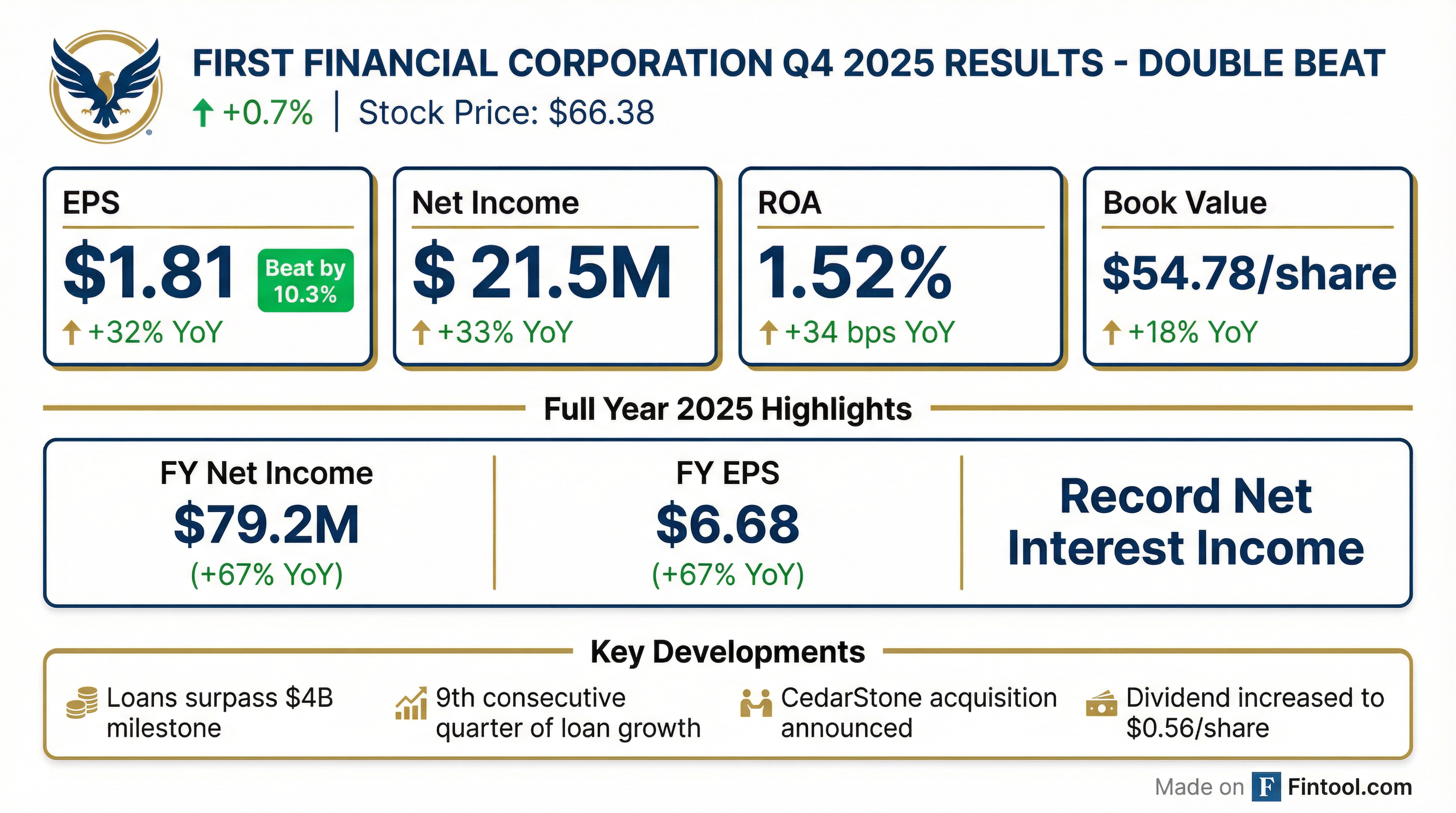

First Financial Corporation (NASDAQ: THFF) delivered a strong finish to 2025, reporting Q4 EPS of $1.81 that beat consensus by 10.3% and capped off a record year for the Indiana-based regional bank. Full-year net income surged 67% to $79.2M, with loans crossing the $4 billion milestone for the first time in company history.

Did First Financial Beat Earnings?

Yes — decisively. First Financial beat on both EPS and revenue for the fourth consecutive quarter:

The beat was driven by record net interest income of $60.6M (+22% YoY), which included a $4.6M interest recovery on a previously impaired credit acquired in a 2019 merger.

Beat/Miss History — 4 Consecutive Beats

Values retrieved from S&P Global

How Did the Stock React?

THFF shares rose +0.7% to $66.38 in early trading, approaching their 52-week high of $66.95. The stock has rallied 57% from its 52-week low of $42.05, significantly outperforming the KBW Regional Banking Index.

Key valuation metrics:

- Market Cap: $787M

- Price/Book: 1.21x (book value $54.78)

- Price/Tangible Book: 1.47x (TBV $45.15)

- 50-Day Avg: $61.81

- 200-Day Avg: $56.10

What Changed From Last Quarter?

Positives

-

Loans crossed $4B for the first time — Total loans reached $4.06B, up 5.7% YoY and 2.2% sequentially. Growth was driven by Commercial Construction & Development, Commercial Real Estate, and Consumer Auto.

-

Net interest margin expanded — NIM jumped to 4.66% vs. 3.94% in Q4 2024 (+72 bps YoY), benefiting from higher loan yields and lower deposit costs.

-

Credit quality improved — Nonperforming loans fell to 0.36% of total loans vs. 0.49% last quarter.

-

Capital strength — Tier 1 leverage ratio improved to 11.25% from 10.38% a year ago. Tangible common equity ratio reached 9.51% vs. 7.86% YoY.

-

Dividend increased — Quarterly dividend raised from $0.51 to $0.56 per share (+9.8%).

Watch Items

-

Deposits declined — Total deposits fell 3.6% YoY to $4.55B as the bank managed deposit costs lower.

-

One-time items — Q4 included $4.6M in investment portfolio losses (securities sold to reinvest at higher yields) and $2.4M PTO accrual adjustment.

-

Acquisition expenses — CedarStone Financial acquisition (announced Nov 2025) added $1.4M in deal-related costs.

Full Year 2025 — Record Performance

Data from 8-K filing

What Did Management Say?

"We are pleased with our fourth quarter and full year 2025 performance, marking the ninth consecutive quarter of loan growth and surpassing $4 billion in loans for the first time. Additionally, we achieved another record in net interest income and record net income for 2025. We have good momentum as we enter 2026, our capital remains strong and we believe we are well positioned for the current market environment."

— Norman D. Lowery, President and CEO

CedarStone Acquisition Update

First Financial announced the acquisition of CedarStone Financial on November 6, 2025, marking its expansion into new markets. The company incurred $1.4M in deal-related expenses in Q4. No update was provided on expected closing timing or synergy targets.

Balance Sheet Snapshot

Data from 8-K filing

Credit Quality

Data from 8-K filing

Credit quality remains solid. Nonperforming loans declined to $14.8M from $19.3M sequentially as the bank resolved problem credits. The allowance coverage ratio of 325% of NPLs provides a healthy cushion.

Forward Catalysts

- CedarStone integration — Deal closure and integration progress in 2026

- Loan growth momentum — 9 consecutive quarters of growth with strong pipeline

- NIM sustainability — Management's ability to maintain elevated margins as rates stabilize

- Capital deployment — 518,860 shares remain authorized for repurchase

Key Risks

- Deposit competition — Continued pressure on funding costs if rates remain elevated

- CRE concentration — Commercial real estate exposure amid macro uncertainty

- Integration execution — CedarStone deal execution risk

- Rate sensitivity — NIM compression if Fed cuts rates aggressively

About First Financial Corporation

First Financial Corporation (NASDAQ: THFF) is the holding company for First Financial Bank N.A., the fifth oldest national bank in the United States. The bank operates 79 banking centers across Illinois, Indiana, Kentucky, Tennessee, and Georgia.

Analysis generated by Fintool AI Agent on February 3, 2026. Data sourced from company 8-K filing and S&P Global estimates.

Related: